Soda & Lies: Why Risk Managers Should Sit in on Marketing Meetings

Prebiotics and gut health are the health trend du jour, but as an elder Millennial who grew up thinking SlimFast and a serving of SnackWells was an acceptable meal, I’m a bit jaded when it comes to just about any new health trend. Perhaps the folks that brought the class action case against Poppi beverages felt the same way.

Poppi leaned heavily into the gut health claims in order to promote their product, but they were faced with a class action lawsuit alleging that they knew that their claims were misleading. With only 2 grams of fiber in each can, the benefits of prebiotics were negligible, and certainly offset by the amount of sugar in each serving. They recently settled the class action suit for $8.9M.

Which leads us to our risk management question:

If your company is sued for false and/or misleading advertising, is this covered by your insurance?

That depends…did your marketing team knowingly make a false statement?

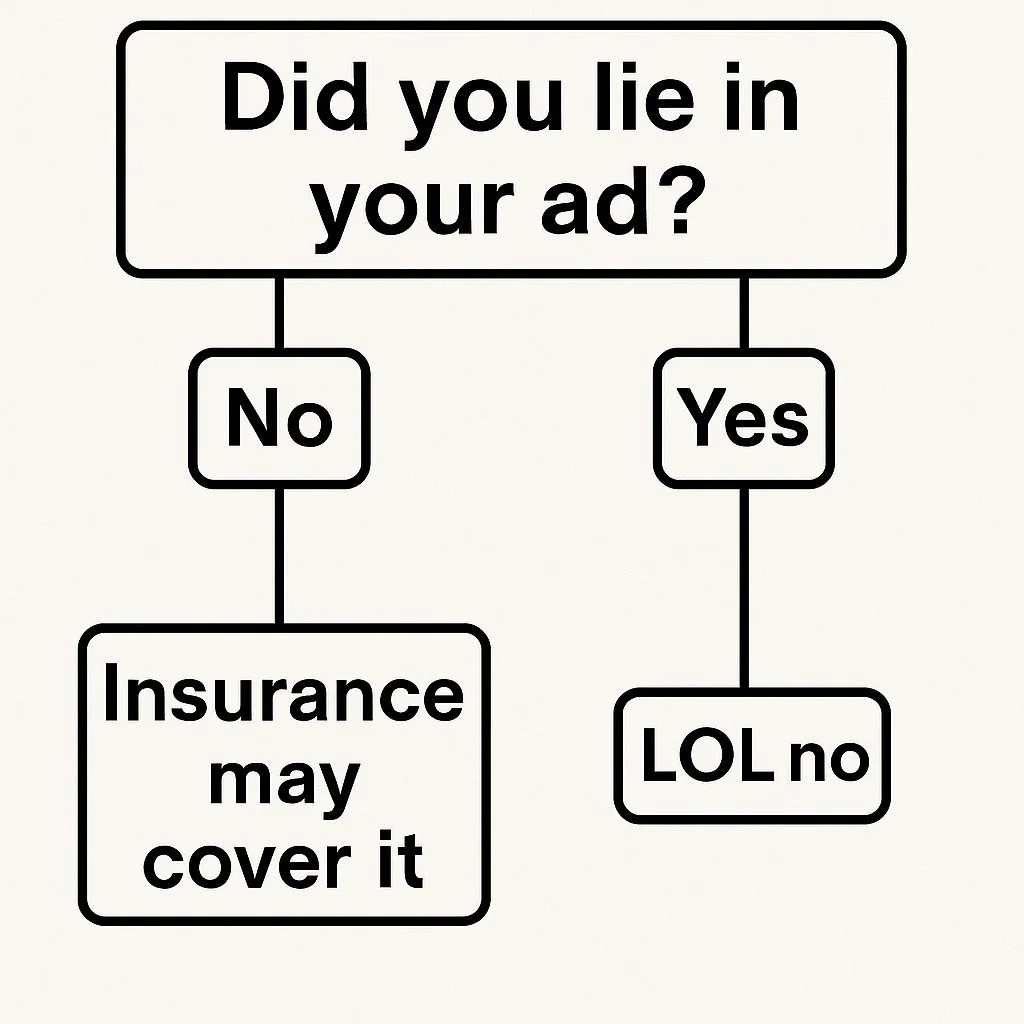

I made a flowchart to help you out:

I like making flowcharts!

Most policies exclude intentional acts, so the distinction is important.

Commercial General Liability policies can sometimes cover claims of defamation, libel and slander, but often draw the line at anything intentional. If you’re looking for something tailored to this specific risk, you can check out Media Liability policies which usually cover misleading ads.

How frequently your team made the misleading claim also comes into play. One of the fatal blows to Poppi’s defense was the fact that they plastered all of their marketing channels with “gut health” claims. It was on TikTok, Instagram, printed advertisements…they even printed “For a Healthy Gut” on their cans!

If you’re in Risk Management, do yourself a favor and check in on the marketing team once in a while. They’ll probably make you participate in a TikTok video, but at least you’ll know what they’re up to.